Top 3 Customers Expectations of Payments

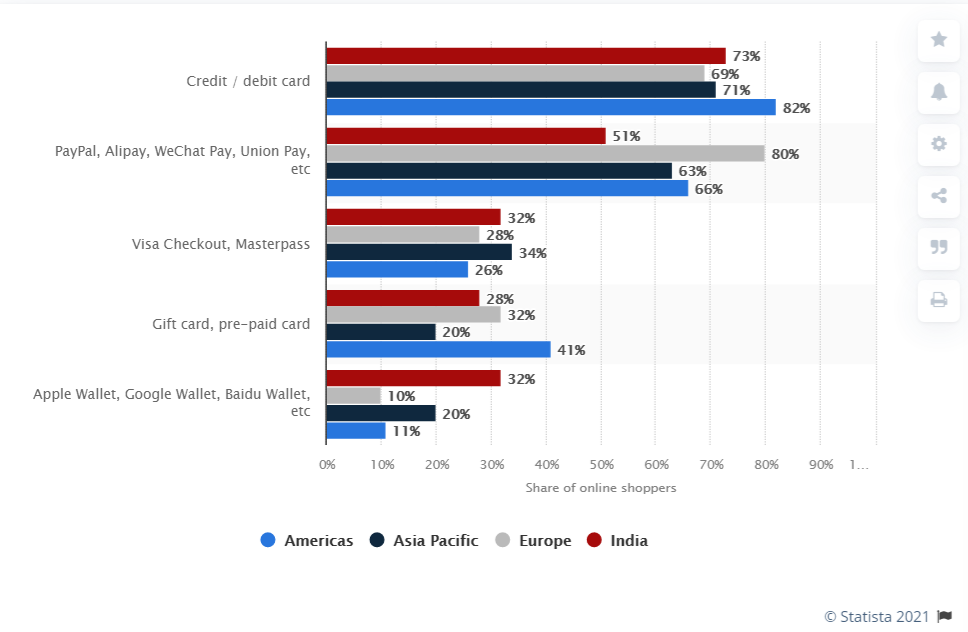

As of 2021, the majority of shoppers still prefer to use credit or debit cards for their orders. It may not feel like that, with the rise of alternative payment methods like Buy Now Pay Later (BNPL) such as AfterPay and Klarna. Or with more frequent sightings of third-party checkouts like ApplePay and AmazonPay.

Customers are open to trying these new methods. It’s estimated that around 29 million US customers have paid with a BNPL method within the last 12 months of writing this article.

Why are customers willing to jump to some new payment methods and not others? There are a few expectations customers have when making payments online:

- It helps reduce friction in the checkout

- It’s safe and secure

- It can help them afford items and save on fees

In this article, we’ll walk through these expectations and new trends in the payment space that you should be paying attention to.

What Customers Expect

Ecommerce customers want to find a product and buy as quickly as possible. Nobody likes to spend time filling out a checkout page only to get an error and have to re-enter information.

It’s been found that “15% of customers abandon the shopping cart for a better in-store experience” and “6% abandon due to lack of payment options” (source).

You don’t want to lose a customer just because you don’t offer the payment method to which they are loyal. And you also don’t want to lose a customer because they’re too scared to put their details into your checkout because it looks unsafe.

Keep reading and you’ll learn how to ensure customer payment expectations are met. Then you can convert more people once they’re ready to buy.

Helps Reduce Friction

Customers spend most of their shopping time researching and finding a product. The last thing you want is for them to get held up in the checkout because their preferred payment method isn’t offered.

By default, you should be accepting all the major credit cards, as well as PayPal. After those are covered, you get into the alternative payment methods that are growing in popularity.

In Shopify reports, you can look at your finance reports and see the most used payment methods. This is a way you can gauge the popularity of certain methods like ApplePay or GooglePay. Test out new payment options like the Buy Now Pay Later ones such as AfterPay and Klarna.

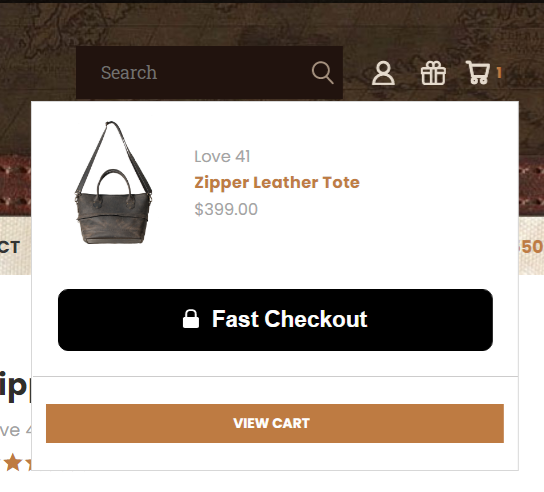

Run tests to see if these payment methods should be shown only in the checkout or also in the cart or drawer cart (if your site uses one). These different placements can help speed up a purchase, letting visitors avoid needing to enter their information or get up to grab their credit card.

New payment methods are arriving every month. Some stores are now accepting crypto payments with tools like Coinbase Commerce. As crypto becomes more mainstream, it’s likely customers will start expecting to be able to pay with these currencies on major store sites.

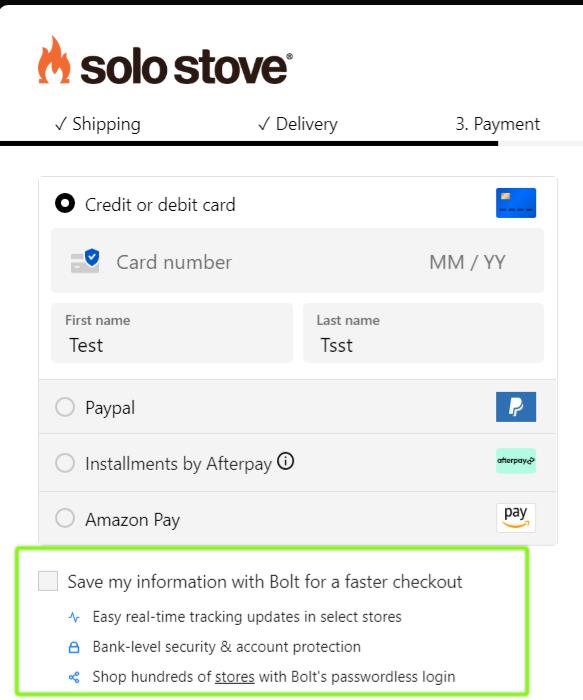

Other stores are now offering one-click checkout methods like Fast and Bolt. These allow customers to click one time to checkout (after having made an account). This is the ultimate low-friction way to checkout, but it’s still very new and many customers will still be unfamiliar with this payment method. New checkout options like this require education, but once a customer gets used to it, they’ll likely choose the frictionless method of checking out over the old way.

Consider testing out new payment methods to see if your customers prefer them. Compare conversion rates among credit card users and these faster checkout methods to see the performance.

Safe & Secure

A 2018 Thales Data Security Report revealed that 75% of U.S. retailers have had at least one security failure with their ecommerce stores. Hackers are getting more and more sophisticated and consumers want to protect themselves. One of the easiest ways for them to do this is to avoid using a checkout that looks untrustworthy in the first place.

Customers are wary of inputting their payment details in stores they are not familiar with for fear their credit card number will be stolen or their identity could be compromised.

It’s important that you’re offering credible payment options for customers such as PayPal and all the major credit cards. These methods often allow customers to issue chargebacks, in case they never receive their order or experience fraud on an untrustworthy store.

It’s important that your checkout reassures customers that your site is secure and you are taking the proper precautions.

A simple A/B test you can run is adding a security reminder on the payment step. This tells customers that your store is using encryption and SSL (or whatever other technology you’re using) to store and process their payments.

You can also test security badges from companies like Norton. Prior research was done into this a few years ago by ConversionXL. They found that badges from well-recognized companies like Google and Norton were perceived as more secure. You can run a similar test on your store with some of these badges (a few of these badges cost money so consider that before running a test).

Afford More and Save on Fees

Nobody likes using a payment method that costs them money. We all know the feeling when you go to a smaller store to buy one item. You get to the checkotu and see you’re required to spend $10 minimum in order to use a credit card.

Customers hope to save on fees they might have otherwise incurred.

Take BNPL providers. They allow customers to take a larger purchase and break up the payments. Rather than pay $200 upfront, they can pay four installments of $50 with no interest if they make all the payments on time. If this same customer tried to get a loan for $200, they’d likely incur interest automatically.

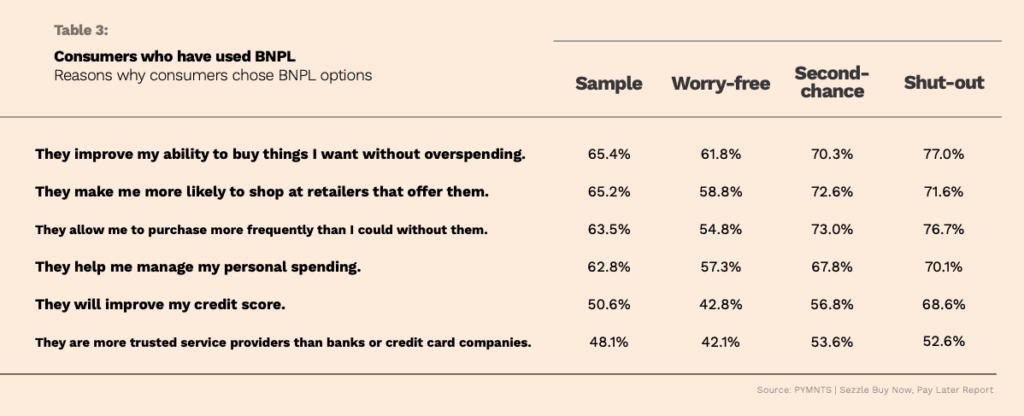

BNPL methods allow users to afford (and spend) more. These payment methods can be controversial because critics say they allow customers to purchase more than they can afford. But users like these methods because they can buy what they need when they need it, without incurring interest or fees.

Many merchants are adopting BNPL to allow customers to afford more and save on costly interest fees. According to The Payment Methods Report 2021, 55% of consumers reported spending more money when they used BNPL at checkout compared to a different type of payment.

It’s very likely that more new innovations will come out of the payments space in the future. With products like self-repaying loans in the decentralized finance space, who knows what’s next for the ecommerce payment world.

What Else Can You Do?

Money, finance, payment methods. All of these sectors are constantly changing. Decades ago we all used cash. Now we’re in a world of digital currencies like Ethereum and mobile wallets like ApplePay. It’s important to keep up with these changes so you’re always meeting customer expectations.

To make sure customers are seeing the payment methods they like to use, you can survey them about payment method expectations. Ask things like:

- What methods do they want to see?

- What method do they use most often?

- Why do they like that method?

- What method would they never use and why?

If the majority of your customers are over 50 and always use a credit card, it’s unlikely they’ll start using crypto payments anytime soon. But that doesn’t mean they never will, so ensure you’re always getting new information from your customers.

We tend to want to focus on the shiny parts of our stores, like the product pages and merchandising. But payments are a crucial part of any store. It’s important to always stay on top of the latest trends and keep up with consumer demands.