Ecommerce Payment Options to Better Serve Your Customers

Last week the Magento team published an article entitled, How Will ‘Uberfication’ Change the Future of Commerce?. It illustrated how Uber created an effortless process–customers solicit a ride, get in and out of the car, and pay without ever handling cash or credit cards. The payment happens behind the scenes: “When you exit the car, the transaction happens invisibly.”

Customers are getting used to Uber’s level of ease in payments, and we’re transferring this expectation to other transactions. In particular, shoppers now want faster and easier options to pay for their online purchases. Thankfully, several companies are helping online merchants answer this challenge. Today we’ll look at various solutions to bring ultra-ease and convenience into accepting payments from your online shoppers.

Related: 22 Rules for Online Checkout

To begin, let’s underscore why online merchants should consider expanding their payment options: according to a recent survey by the Baynard Institute, approximately 8% of shoppers abandoned their carts due to lack of payment options. In offering more payment options, retailers directly counter this reason for cart abandonment.

Here are some payment methods that shoppers increasingly embrace, and that provide online merchants the opportunity to convert more sales.

Affirm

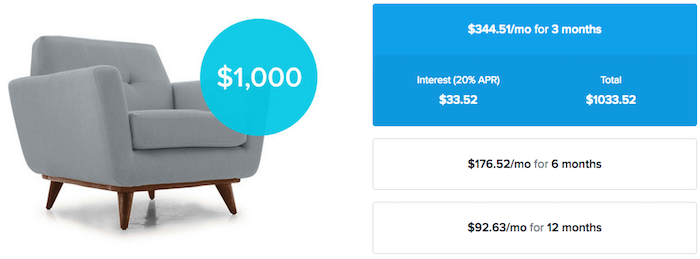

Founded in 2012, Affirm offers installment plans for online purchases. Today it’s used by over 1,000 online retailers. (We recently implemented it for two of our clients.) With Affirm, shoppers pay for purchases greater than $100 in 3, 6, or 12 month installments. For purchases between $50-$99, Affirm gives shoppers the option of 3 or 6 month plans. The interest rate on the loans varies between 10%-30% (some merchants offer 0% APR). Affirm does not charge compounded interest or late fees.

To begin, merchants add Affirm as a payment method in their checkout page. (Take a look at Blu Dot. They have a strong checkout page and offer Affirm.) After a shopper selects Affirm at checkout, she answers a few questions as part of a “soft” credit check. This means that the Affirm inquiry will not show up on her credit report. Once she’s approved for the loan, she’ll begin payments 30 days after approval. Affirm reminds customers of payments due through SMS text, and monthly payment are most often submitted directly through their website, but they do accept checks, too.

Affirm reports the option to pay over time helps online retailers increase conversions, especially with high-priced ticket items. We were particularly impressed by their Peloton case study. Peloton makes exercise bikes ranging from $2,000-$3,000 and up. Since adding the Affirm option, their conversions have risen by 15%. Affirm payments now account for 30% of their online sales.

The concept of offering shoppers the ability to pay over time is gaining traction in other countries, too. Australia and New Zealand online merchants are now using Afterpay. It is very similar to Affirm, however, all payments must be completed within four installments.

Apple Pay

Online shoppers are rapidly adapting to digital wallets, and Apple Pay is leading the charge. Over the summer, TechCrunch reported, “Apple Pay now has the largest percentage of supporting U.S. merchants, with 36 percent accepting the technology, up from 16 percent the year before.”

Perhaps the biggest reason for Apple Pay’s growth is due to the expansion of mobile ecommerce, a.k.a. mcommerce. In 2014, mcommerce made up 11.6% of ecommerce sales. Business Insider forecast mobile to grow to 45% of ecommerce sales by 2020. It’s likely that Apple Pay will have a major role in making that happen.

Customers activate their Apple Pay account by adding their preferred credit or debit card to their Apple Wallet. From there, they follow the prompts on their Apple device to set-up Touch ID on that device. Then when they want to pay for something with Apple Pay, they hover their thumb over the device’s home button. The device registers the shopper’s thumbprint and confirms the sale. It’s a seamless system with one important note: Apple Pay only works on Safari. It doesn’t work on through any other web browsers.

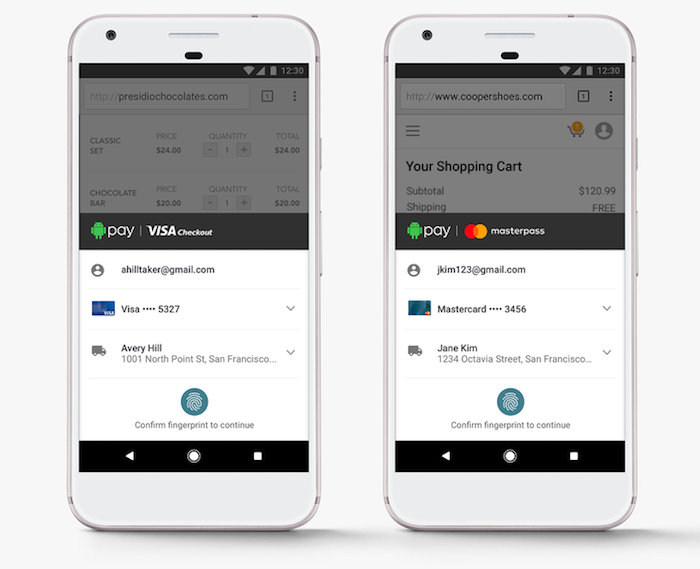

Android Pay

Yes, the iPhone continues to be the most popular smartphone in the world, but online merchants have opportunity to grow with Android payments, too. Shoppers with Android devices download the Android Pay app, upload their credit or debit card to it, and they are ready to purchase. From there, the Apple Pay and Android Pay experiences are very similar, the only real difference being that each payment method is tailored to its device.

Both Android and Apple pay options provide an extra layer of security for shoppers. In Android’s own words, “When you use your phone to pay in stores, Android Pay doesn’t send your actual credit or debit card number with your payment. Instead we use a virtual account number to represent your account info–so your card details stay safe and secure.” (Apple Pay has similar security language.) Thus, not only are these forms of payment more convenient for mobile shoppers, they give people greater peace of mind.

Android Pay only works with web checkouts via Google’s Chrome browser. Also, for retailers on Shopify: Shopify implemented Apple Pay into all its platform stores in June of 2016. Android Pay is still “Coming Soon” to Shopify. The platform’s roll-out sequence for these two payment options shows Apple Pay’s dominance.

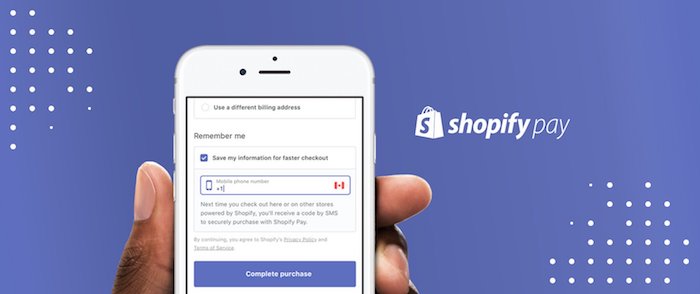

Shopify Pay

Perhaps one of the reasons that Shopify has been slow to adopt Android Pay is because, earlier this year, they debuted their own payment option. Shoppers can use Shopify Pay for all online stores on the Shopify platform. (Neither the shopper’s device, nor browser, is a factor.) As of last month, there were over 500,000 stores on Shopify, selling from 175 countries around the world.

In a recent press release, Shopify stated, “Mobile traffic to merchants’ stores continued to grow, reaching 72% of traffic and 60% of orders for the three months ended June 30, versus 69% and 59%, respectively, exiting the first quarter of this year.” The continual growth in mobile shows the need for Shopify Pay.

Here’s how it works: Shoppers opt-in to enter their shipping and payment information into Shopify Pay. This information is then “encrypted and securely stored on Shopify’s PCI compliant servers,” as explained by Shopify.

Then, when the shopper makes a purchase in a Shopify store, she only needs to enter her email at checkout. After writing in the email, the shopper gets an instant verification code via that email. She enters the verification code and DONE. The purchase is complete.

The best part is that the shopper payment and shipping information stays with Shopify. The customer only has to submit her info once. From then on, in any and every Shopify store, she buys through the vastly-simplified Shopify Pay process. A typical checkout process has 16 fields of information to enter. All these fields are really tedious, especially on mobile. With Shopify Pay, customers enter an email and then the verification code. Now we’re down to 2 fields–sweet!

Amazon Pay

With Amazon’s 300+ million account holders (and that was as of 2015!) Amazon Pay, its checkout process, is available to all online merchants, regardless of whether or not they sell on Amazon. Once a merchant activates Amazon Pay on his site, shoppers simply click “Pay with Amazon” to pay with the billing and mailing information stored in their Amazon account.

In Amazon’s promotional materials for merchants about Amazon Pay, the company repeatedly emphasizes customer trust in their checkout process. People are buying through a system they have relied upon for years. Also, Amazon promotes its “A to Z Guarantee” for all third-party purchases via Amazon Pay. This means that shoppers are promised to receive their purchases in the correct condition and timeframe as agreed upon with the third-party. If the shopper is unsatisfied, Amazon will reimburse her.

While all this could help grow a non-Amazon retailer’s sales, there’s a multi-step application process for implementing Amazon Pay. Amazon charges fees for processing payments, too. Please see the merchant link above for details on fees.

As we look ahead to the busy holiday season, Apple Pay, Android Pay, Shopify Pay, and Amazon Pay are all payment methods that help shoppers buy quickly and easily. This is especially true for customers on their phones and other devices. Affirm, the first ecommerce payment option we listed here, can boost sales by allowing shoppers to pay in installments, rather than all at once. Each and every one of these products helps online retailers better serve their customers. Which ones should you add to your online store? Drop us a line and let’s discuss.